And it's not your fault.

Let me explain why:

Every Monday morning, you're staring at a CRM full of "opportunities" that look promising on paper but feel hollow in your gut.

- L1/L2 "interested in exploring partnership."

- Market maker "evaluating solutions."

- Family offices "taking meetings to stay informed."

Your forecast spreadsheet shows a healthy pipeline, but you know the truth, they aren't buying.

In fact, you're not actually selling. You're participating in "fuck around"

You've made the unquestioned, unconsidered decision that every crypto sales leader makes without knowing they made it:

"We're going to compete for the same accounts as everyone else because that's where the 'real' opportunities are."

So your pipeline fills with fake opportunities while real buyers are completely invisible to your sales process.

Which leads us to...

The Gravity Pull Of Copycat-Holes

Everyone is building

- another "cheaper" oracle that's gonna crush Chainlink/Pyth/Redstone

- another "faster" swap that'll make Uniswap obsolete

- another "better" infra with even faster things

Another "bigger, better, faster, cheaper" that'll dethrone whatever incumbent.

And the GTM? Just copy what the incumbents did.

Unsurprisingly, you find yourself missing revenue forecasts.

Here's the data: In tech, one company — the category king — earns 76% of total market value.

Not market share. Market VALUE.

So when your company makes that unconscious decision to compete instead of create, you've just said, "We're gonna fight for the 24%."

Meanwhile, you are ignoring the real opportunity.

And your "spray and pray" GTM strategies, which treat all crypto companies as if they're the same buyer with the same problems, don't resonate.

And not just that.

You know what's killing your close rates?

Your founders think the best product wins.

Your product team thinks that if they build it 10x better, buyers will come.

And they've made you the salesperson for their delusion.

Andre Cronje built Yearn Finance for free.

No funding, no fees, just a common good that generated incredible yields with low risk. You know what happened? The crypto community tore him apart. Users complained daily. The community picked apart every decision. He had to wake up at 3 AM to defend himself on Twitter.

This is your market.

- Entitled users who expect everything for free.

- Hostile communities that attack builders.

- Incumbents with infinite budgets for bribes and incentives.

And your founders think their "cheaper" oracle/crypto data/infra solution is gonna win this war?

You're bringing a feature comparison sheet to a category fight.

And deep down you know.:

Your prospects don't give a shit about your 3% faster latency or your "more decentralized" architecture. They care about solving problems that existing solutions don't address.

But your company built a "better Chainlink" instead of solving a different problem entirely.

So now you're stuck selling incremental improvements to buyers who already have working solutions.

You're explaining why they should rip out infrastructure that works fine to replace it with your marginally better version.

No wonder your close rates are shit.

Vertical Velocity is your only escape from the Copycat-Hole

What if the "competitive" crypto B2B market is actually dozens of blue ocean verticals with real buyers who have urgent, unmet needs?

What if DeFi lending protocols, cross-chain gaming infrastructure, and institutional privacy platforms have completely different pain points, budgets, and buying processes? What if treating them as one market is the strategic error that's keeping your close rates in the toilet?

Vertical Velocity is the systematic building of compound momentum within specific crypto market segments.

Just like category design principles, you don't just sell products—you design demand within vertical markets. Instead of fighting seven competitors for one fake "key account" opportunity, you become the definitive expert who owns entire verticals.

Your first deal with a yield farming protocol makes the second one 50% faster because you understand their specific JTBDs, technical architecture, and risk management concerns. Your third deal makes the fourth inevitable through vertical-specific referrals and proven use cases.

You start to create predictable revenue streams in markets where you're the only vendor who cares.

The Stakes Are Career-Defining

Every quarter you spend chasing fake opportunities in oversaturated markets, systematic competitors are building unbreachable positions in vertical markets you don't even know exist.

They're becoming the go-to experts while you're still trying to get callbacks from prospects who were never going to buy.

Revenue leaders who master Vertical Velocity become impossible to replace.

When the next crypto winter hits, generic "relationship building" with randos will become worthless overnight.

The survivors will be the vertical specialists who built systematic demand generation in markets that buy regardless of market cycles.

Achieving Vertical Velocity

The crypto B2B market is maturing.

Enterprise buyers are developing sophisticated procurement processes. This evolution favors sales leaders who understand vertical-specific buying behavior over those who treat all crypto companies as generic "prospects."

Here's the playbook:

Vertical Market Mapping: Stop assuming all "crypto companies" buy the same way. Systematically identify segments with shared pain points, budget cycles, and decision-making processes.

Problem-First Selling: Don't lead with your solution. Lead with a deep understanding of vertical-specific problems that existing vendors ignore or handle generically.

Compound Territory Building: Create systematic advantages within verticals where each closed deal strengthens your position for adjacent opportunities in the same segment.

Real Demand Creation: Build relationships with actual buyers who have budgets and urgency, not industry celebrities who take meetings for market intelligence.

You've got two choices:

Choice 1: Keep chasing fake opportunities. Keep competing with 7+ vendors for accounts that string you along. Keep measuring success by activity metrics instead of closed revenue. Keep hoping your spray-and-pray approach will eventually work.

Choice 2: Start building Vertical Velocity. Design systematic sales processes around actual buyer behavior in specific crypto market segments. Own entire verticals where you're the obvious choice instead of one of many options.

Now is the time to choose.

Okay banger, so how do I achieve Vertical Velocity? And does it work?

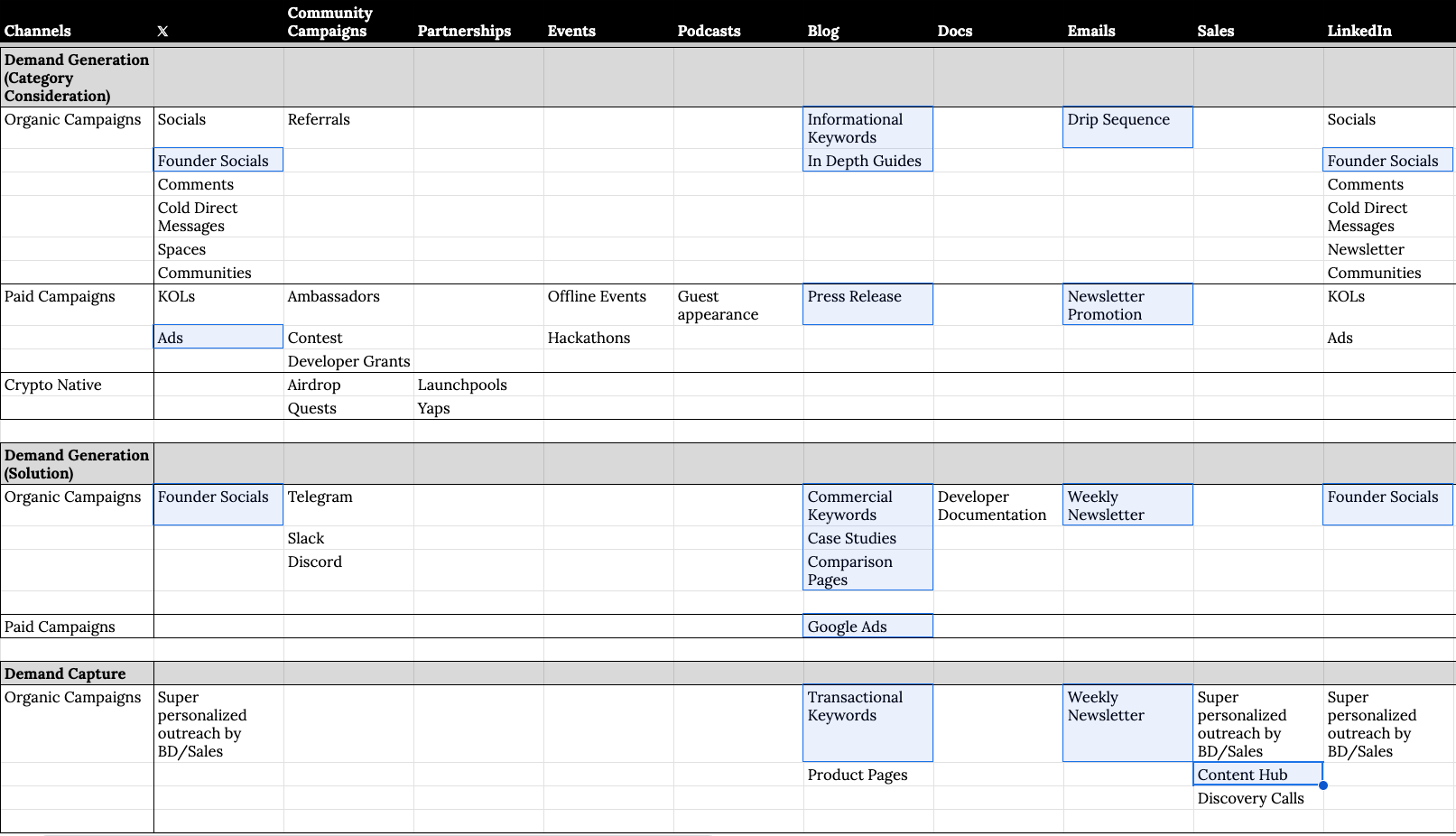

I use content to help you achieve Vertical Velocity and get net new revenue

- Social selling through ghostwriting

- Ranking for commercial and transactional intent keywords

- Newsletter / nurturing sequences

- Paid social and search ads

- Content hub/deal rooms

Read my case studies below:

Ghostwriting for B2B crypto executives

Most executives come to me because they are

- trying to grow pipeline using 𝕏 or LinkedIn

- sick of doing outbound and want to "graduate" to inbound

Growing pipeline for enterprise B2B SaaS using his personal brand

Stats:

- Founder raised $5M.

- ACV is $60K-$100K.

- Multi-stakeholder buying committee

What he was trying to do:

- Grow pipeline with socials

What we did:

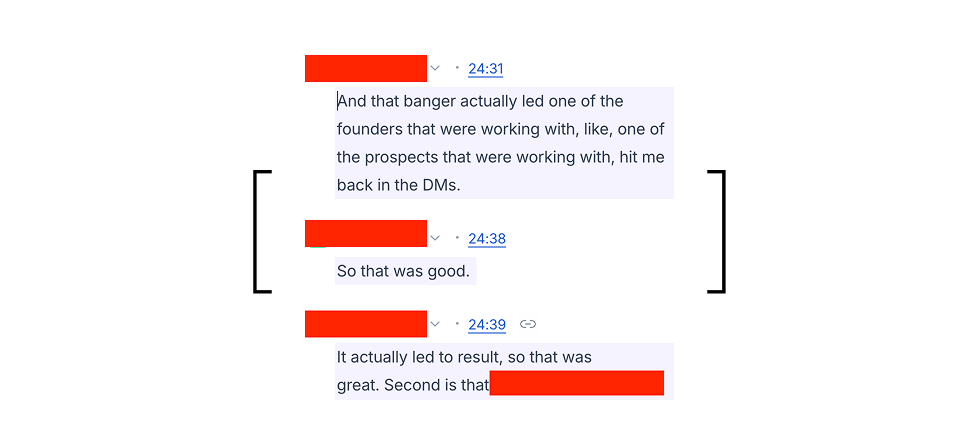

- Wrote a personal story to bait engagement from top leaders in the space

Result:

- Prospect replied to DM

Raising Capital

This founder was trying to raise a second round.

We wrote a personal story thread and received a few DMs. He's now on his way to raise another $2M.

It's me

Just to show you that I truly understand what makes threads go viral.

My account has only 2k followers.

Best tweet ever:

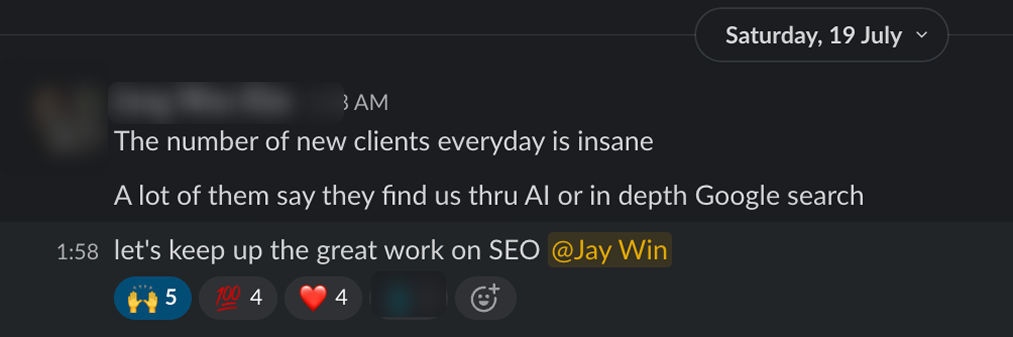

The co-founder came to me asking if I could boost his other co-founder (inbound)

First week of working together:

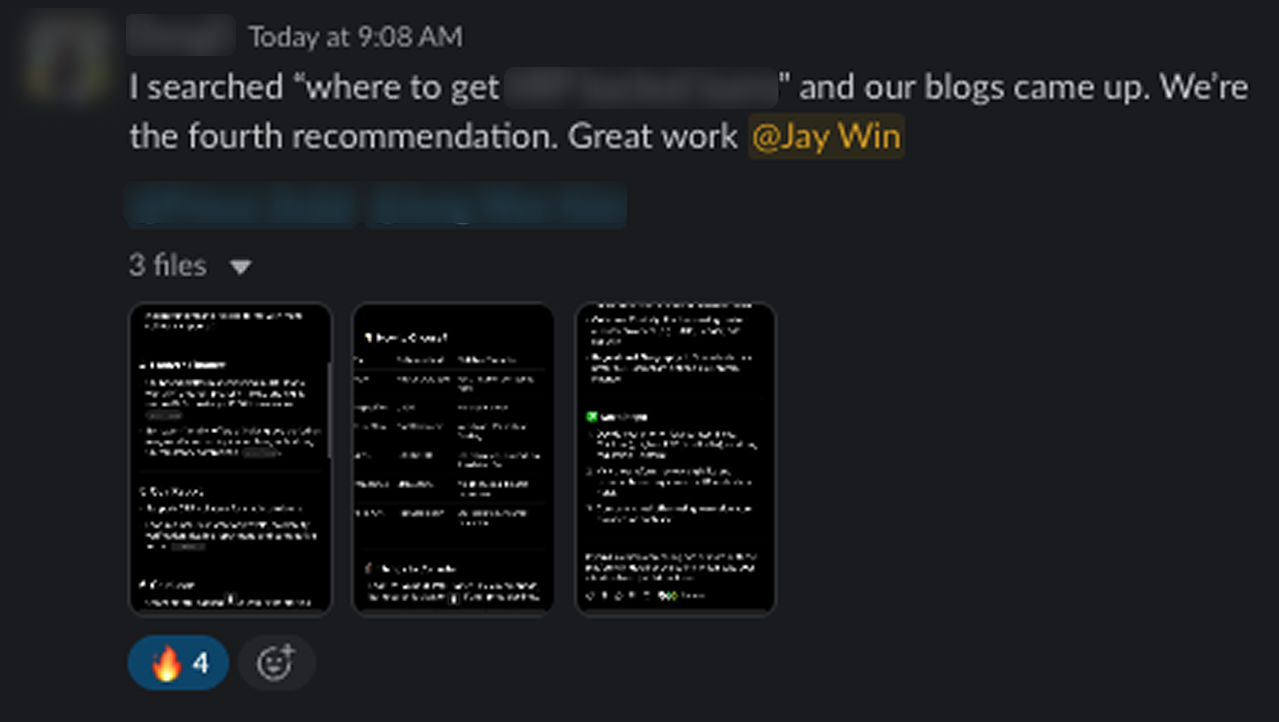

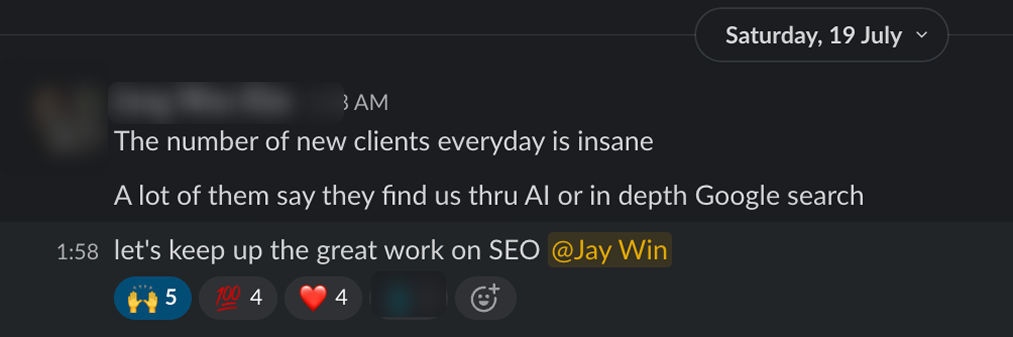

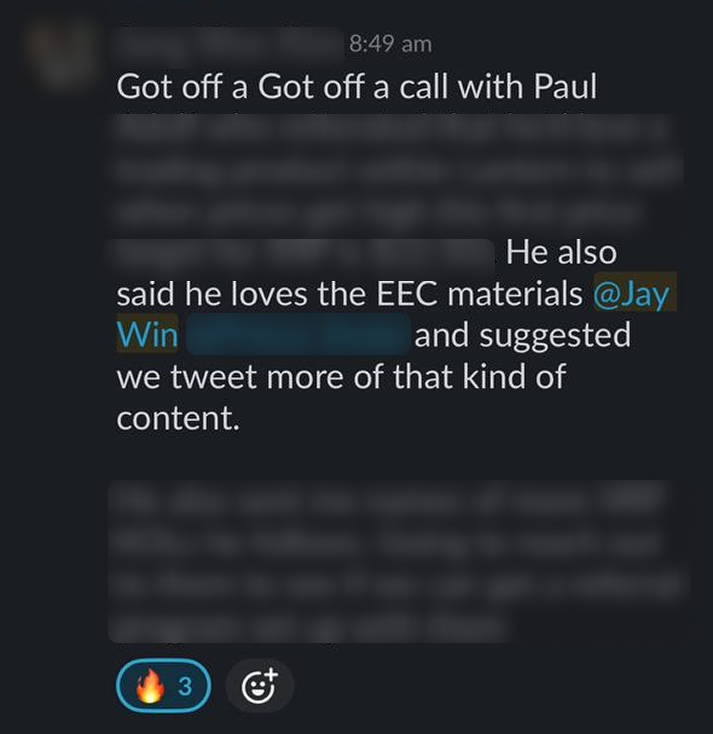

SEO + Drip Sequence + Paid Ads

Once we truly understand our target market and ICP (after tons of sales calls), we can now try to generate more inbound using SEO

Case Study: Founder of self-serve financial platform

Remember the founder who was trying to raise capital?

We have now graduated from doing outbound to doing inbound.

With our learnings, we experimented with running two ad campaigns (𝕏 and Google) while focusing on ranking for high-buying intent keywords.

Drip sequence

Educational email course for new sign-ups.

The idea here is to educate, not sell. We want people to be excited to receive emails from us. Same idea for the newsletter.

After sending 3000+ emails, our unsubscribe rate is 0.4%.

Result: 76% in total revenue in 30 days with two ad campaigns + ranking first on high-buying intent keywords + drip sequence

Here are the other channels that I work on to help you achieve Vertical Velocity:

And obviously, we always start with co-creating the GTM strategy

GTM lead of a funded privacy focused protocol DM-ed me.

Background:

- Experience across Oracle solutions, DEX platforms, and L2 ecosystems

- Strong network-building capabilities (50+ leads in 3 months at a DEX)

- Active contributor to major protocols (Optimism governance)

- Facing transition to a senior GTM leadership role

I sent him a 15-minute video.

The Problem: Surface-Level Targeting

When he first reached out, he was experiencing a common challenge in crypto B2B: knowing who to target but lacking the strategic framework to effectively segment and approach different customer types.

"The exact problem I had was exactly what you did to break it down... I know the ICPs. I know, oh, this is like the main personas you're targeting when you're building this. But the total breakdown, the total way you dismantle everything and give it bit by bit process of how you go about everything, how you see everyone, how you target them, how you treat them. That was what I was lacking."

Initial State: Knew what to do but lacked how to do it systematically

Final State: Possesses frameworks to analyze, segment, and approach complex B2B markets strategically

Vertical Velocity transforms crypto BD professionals from tactical executors into strategic leaders, providing them with the analytical depth and systematic approach necessary to succeed in crypto's complex, fragmented markets.